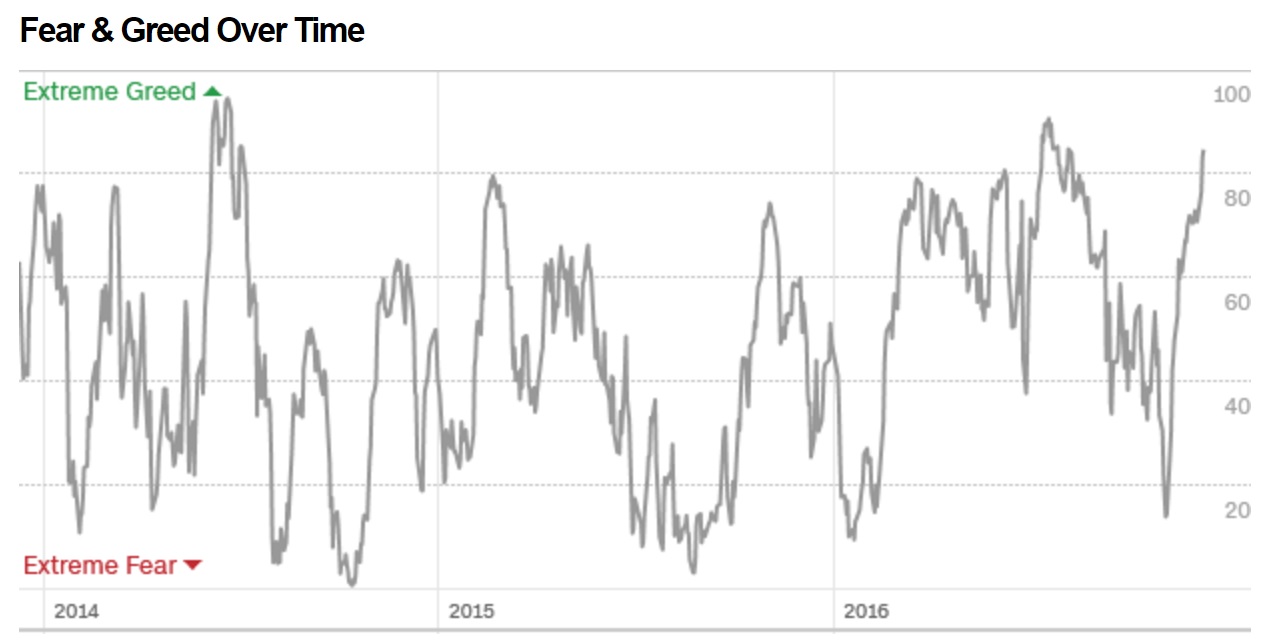

Have you ever heard of the Greed Index? This fascinating concept measures the level of greed in the financial markets and can give valuable insights into investor behavior. The Greed Index, also known as the "贪婪指数" in Chinese, is a tool that helps investors gauge the level of greed or fear in the market.

The Greed Index is calculated based on various factors such as stock price movements, trading volumes, and investor sentiment. When the index is high, it indicates that investors are being greedy and optimistic about the market. Conversely, when the index is low, it suggests that investors are fearful and cautious.

According to recent data, the Greed Index is currently at a high level, reflecting the exuberance in the financial markets. This could be a sign that investors are taking on excessive risks and may be overly confident about future market performance.

It is essential for investors to pay attention to the Greed Index as it can help them make more informed decisions about their investments. By understanding the level of greed in the market, investors can adjust their strategies accordingly and avoid making impulsive decisions based on emotions.

So, what are some key takeaways from the Greed Index? Firstly, it is crucial to remember that market sentiment can change rapidly, and it is essential to remain cautious even during times of high greed. Secondly, investors should diversify their portfolios to mitigate risks and avoid putting all their eggs in one basket.

Additionally, keeping a close eye on the Greed Index can help investors identify potential market bubbles and avoid getting caught up in the hype. By staying informed and making rational decisions, investors can protect their investments and navigate the ups and downs of the financial markets.

In conclusion, the Greed Index is a valuable tool for investors to understand market sentiment and make more informed decisions about their investments. By monitoring the index and staying vigilant, investors can navigate the complexities of the financial markets and build a more secure financial future.

Keywords: 贪婪指数, Greed Index, financial markets, investor behavior, stock price movements, market sentiment, risks, market bubbles, investments, market performance.

Frog With Pants: A Fashionable Trend Or Just A Hilarious Gimmick?

Irene Zola Legacies Tm 2010

Richard Damm Oregon: A Prominent Figure In The Business Community